Friends, here is a tutorial on how we got here and how to prepare for the worst.

The Federal Reserve (Fed) offered Quantitative Easing (QE) 3 times. At first it saved the big banks and the stock market started going up. But then the Fed kept giving out easy money to the big banks.

Leveraged Loans and Junk Bonds

The banks, that received the QE money, issued junk bonds and leveraged loans that were used for debt creation not real products and services. Specifically QE went to Mergers and Acquisitions (M & A) and oil investments. Here is an example.

Richard Baker, chief executive, along with his investment firm, NRDC Equity Partners, relied heavily on borrowed [leveraged loan] money. Of the $1.2 billion that it paid for Lord & Taylor, only $25 million [2%] came in the form of equity, with the remainder made up of debt financing. [The New York Times]

Do you think any of us could buy a house with 2% down? Nope.

New Bubbles

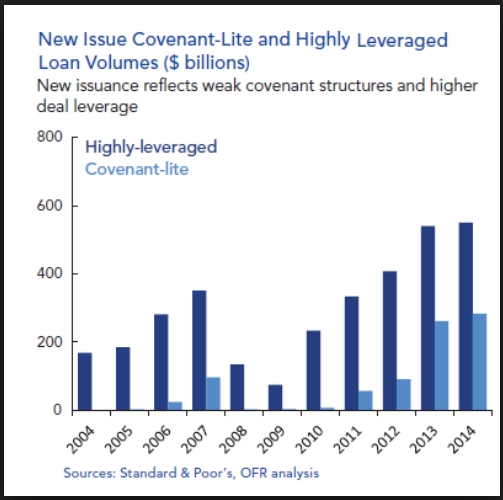

For 2014, three things happened. The dollar reached a new record high, the Dow Jones hit a record 32 times and leveraged loans went back to 2008 pre-recession levels. Some economists are calling this a bubble. Here is a chart to prove it.

See https://michaelekelley.com/2014/12/20/leveraged-loans-predict-crash/

Some Good News

The good news is the stock market is up, gas prices are low and unemployment is back to 2003 levels.

But the Economy Struggles

The economy is struggling for several reasons. First, the easy money went into debt rather than real products which creates jobs. Secondly, very little money went into infrastructure which also creates jobs.

And Wage Inequality Is Greater Than Ever

The CEO to worker compensation ratio is 296 to 1 today versus 20 to 1 in 1965. The rich have gotten richer. Unfortunately the upper class does not change its spending patterns. Several studies have proved this despite what politicians say.

So the economy has stalled even though the stock market is up. Only the middle and upper classes have money to invest in the rising stock market.

Oil Price Drops and Leveraged Loan Bubble Bursts

Oil prices have dropped because of excess supply and over-leveraged oil investors. For more information see this easy to understand website.

http://wolfstreet.com/2014/12/07/bloodbath-in-oil-patch-junk-bonds-leveraged-loans-defaults/

Solutions for the Federal Reserve and Congress

Here are some solutions because blogs should offer solutions rather than just complain about our problems.

There is still time for the Federal Reserve to pump up the economy by providing funding specifically for infrastructure which will create jobs and kick start the economy. Also Congress, or better yet, each state can raise the minimum wage. The economy will only take off if new jobs are created or lower class or middle class people get pay raises.

Here is a list of 7 suggestions that will not soak the rich.

But if the government drags its feet or does more of the same Quantitative Easing, here is what you can do to prepare for the worst.

Solutions for the Rest of Us

https://michaelekelley.com/2014/10/16/8-things-to-do-when-recession-happens/

Lessons From How The Great Recession Happened and What A CDO Is

http://www.ase.tufts.edu/gdae/Pubs/te/MAC/2e/MAC_2e_Chapter_15.pdf

Good luck!