You can probably tell from my, what do you say now, threads that I’m an old guy from an older time. I want to take you back in time. To the turn of the century. Let’s go to January 1, 1900. Long before Y2K, whatever the hell that is. I want to talk about something that’s really important to me.

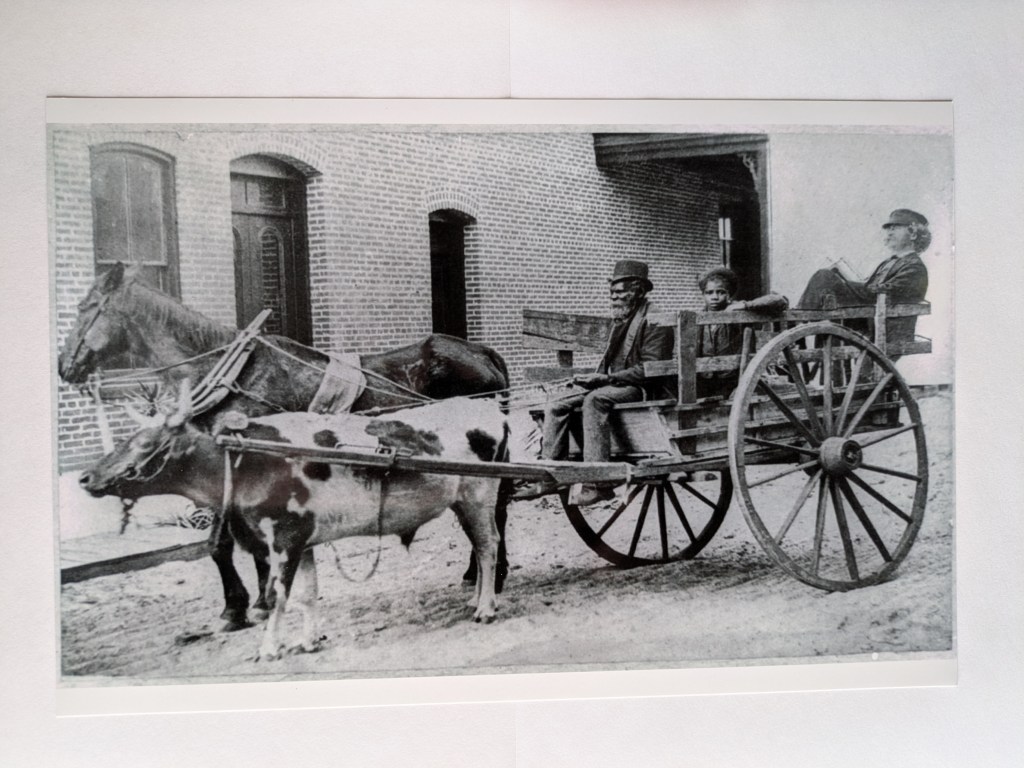

We are on the verge of major change and I want to make sure that we make the right decision. What am I talking about? I’m talking about saving horses and buggies, okay?

A lot of people have invested in horses. A lot of people have jobs in the buggy industry. Okay? And now there’s a new contraption coming out that promises all kinds of things and I’m here to tell you that not all of those things are true.

I am talking about this new magical thing called a horseless carriage.

One of the biggest things that I’m worried about is that horses are wonderful animals. If we switch to a gas-powered motorcar, the lives of thousands of beloved horses are endangered. Maybe hundreds of thousands of horses that we use everyday in our lives.

Everyone loves horses. They are like big dogs. Many are family pets. Why would we want to get rid of a family pet? Why would we want to treat them like trash and throw them out with our garbage?

I have to warn you that one of the biggest dangers of these new gas-powered motorcars is Hello! You’re driving around with a flammable liquid!!! Are you crazy?

Do you want to put what you love the most at risk? No, not your horse. I mean your family! Do you want to drive around with a vehicle that could explode and kill all the members of your family? I mean it sounds insane to me that somebody would ever even think about that.

You know some of the promises that they’re making are just crazy. Things like going many more miles than a horse can go. But what about worrying about how to refill? Where do you find gas to refill your car? It’s insane. It’s not like we have gas stations on every corner.

And also look at the fact that a lot of these horseless carriages cannot get over these rocky country roads. Most of our dirt roads out there have potholes from rain and floods and other natural occurrences. A horse is a beautiful thing and is able to climb over those things and out of those things. But a gas-powered motorcar can’t do that.

In summary, there are so many advantages to staying with a horse and buggy. I’m really worried about the industry of the people that are building our buggies. The people that are helping you actually feed and care for our horses. I don’t want them to lose their jobs. I don’t want to hurt those families. Do you?

So I think it’s in the best interest of everybody that we give up the idea of changing to gas powered motorcars and thus, I want you to sponsor our new organization.

We are creating a giant collection of horse and buggy people, horse organizations, buggy organizations, and veterinarian organizations. We’re all getting together and we’re creating this new organization. We do not want to waste any more of your time, so here’s the name of it:

Responsible Use of Buggies for a Better International Society aka RUBBIS.

Thanks.